Pa Tax Rate On Gambling Winnings

In PA if you have earnings and pay tax on it in another state, then the tax paid on that income, up to the rate of 3.07% of the earnings can be claimed as a credit against PA income tax liabilities. PA no longer allows a credit for foreign income taxes paid on taxable PA income. Pa State Tax On Gambling Winnings Calculator Does tax reform affect lottery winnings? In 2018, the top tax rate was lowered from 39.6 percent to 37 percent. That means you would pay less in taxes this year if you won.

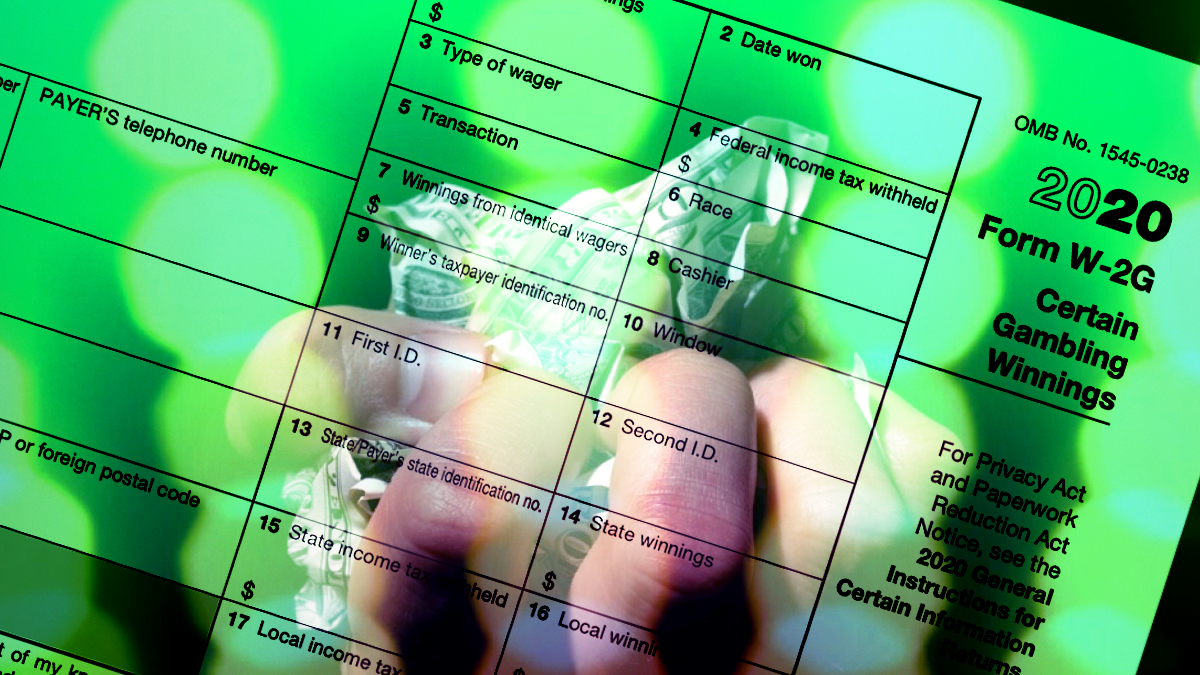

- File Form W-2G, Certain Gambling Winnings, to report gambling winnings and any federal income tax withheld on those winnings. The requirements for reporting and withholding depend on the type of gambling, the amount of the gambling winnings, and generally the ratio of the winnings to the wager. File Form W-2G with the IRS.

- All gambling winnings received from slot machines are subject to federal taxes, and both cash and non-cash winnings (like a car or a vacation) are fully taxable. Apart from slot machines, the same applies to winnings from lottery, bingo, keno, poker or other games of chance.

It appears you don't have a PDF plugin for this browser. Please use the link below to download 2019-pennsylvania-form-pa-40-t.pdf, and you can print it directly from your computer.

More about the Pennsylvania Form PA-40 TIndividual Income TaxTY 2019

We last updated the PA Schedule T - Gambling and Lottery Winnings in January 2020,so this is the latest version of Form PA-40 T, fully updated for tax year 2019. You can download or print current or past-year PDFs of Form PA-40 T directly from TaxFormFinder.You can print other Pennsylvania tax forms here.

eFile your Pennsylvania tax return now

eFiling is easier, faster, and safer than filling out paper tax forms. File your Pennsylvania and Federal tax returns online with TurboTax in minutes. FREE for simple returns, with discounts available for TaxFormFinder users!

File Now with TurboTaxRelated Pennsylvania Individual Income Tax Forms:

Pa Tax Rate On Gambling Winnings Real Money

TaxFormFinder has an additional 174 Pennsylvania income tax forms that you may need, plus all federal income tax forms.These related forms may also be needed with the Pennsylvania Form PA-40 T.

| Form Code | Form Name |

|---|---|

| Form PA-40 | Pennsylvania Income Tax ReturnTax Return |

| Form PA-40 PA-V | PA-40 Payment VoucherVoucher |

| Form PA-40 W-2S | PA Schedule W-2S - Wage Statement Summary |

| PA-40 | Income Tax Return Tax Return |

| Form PA-40 A | PA Schedule A - Interest Income |

| Form PA-40 SP | PA Schedule SP - Special Tax Forgiveness |

| Form PA-40 B | PA Schedule B - Dividend Income |

| Form PA-40 UE | PA Schedule UE - Allowable Employee Business Expenses |

| Form PA-40 C | PA Schedule C - Profit or Loss From Business or Profession |

| Form PA-40 ESR-I | Declaration of Estimated TaxEstimated |

Form Sources:

Pennsylvania usually releases forms for the current tax year between January and April.We last updated Pennsylvania Form PA-40 T from the Department of Revenue in January 2020.

Pa Tax Rate On Gambling Winnings Odds

- Original Form PDF is https://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/PIT/Documents/2019/2019_pa-40t.pdf

- Pennsylvania Income Tax Forms at http://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/PIT/Pages/default.aspx

- Pennsylvania Department of Revenue at http://www.revenue.state.pa.us/

About the Individual Income Tax

The IRS and most states collect a personal income tax, which is paid throughout the year via tax withholding or estimated income tax payments.

Most taxpayers are required to file a yearly income tax return in April to both the Internal Revenue Service and their state's revenue department, which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer's entire liability. Every taxpayer's situation is different - please consult a CPA or licensed tax preparer to ensure that you are filing the correct tax forms!

Historical Past-Year Versions of Pennsylvania Form PA-40 T

We have a total of six past-year versions of Form PA-40 T in the TaxFormFinder archives, including for the previous tax year. Download past year versions of this tax form as PDFs here:

2019 Form PA-40 T2019 PA Schedule T - Gambling and Lottery Winnings (PA-40 T)

2018 Form PA-40 T2018 PA Schedule T - Gambling and Lottery Winnings (PA-40 T)

2017 Form PA-40 TPa Tax Rate On Gambling Winnings Losses

2017 PA Schedule T - Gambling and Lottery Winnings (PA-40 T)

2016 Form PA-40 T2016 PA Schedule T - Gambling and Lottery Winnings (PA-40 T)

2015 Form PA-40 T2015 PA Schedule T - Gambling and Lottery Winnings (PA-40 T)

2014 Form PA-40 T2014 PA Schedule T - Gambling and Lottery Winnings (PA-40 T)

TaxFormFinder Disclaimer:

While we do our best to keep our list of Pennsylvania Income Tax Forms up to date and complete, we cannot be held liable for errors or omissions. Is the form on this page out-of-date or not working? Please let us know and we will fix it ASAP.

Players dream of hitting a big jackpot when they play the slots. When that day comes for you, you'll have questions about the taxes you must pay on the winnings.

Hand Pay Jackpots

When you hit the winning combination of symbols for a large jackpot, your slot machine locks up. Depending on the machine, the lights on top of the machine may come on and start flashing, music may play or bells ring. A slot attendant arrives promptly to see what you have won.

On jackpots smaller than $5,000, an attendant verifies that you hit the jackpot and then assists you in claiming your money at the cashier's cage. In the case of a large or progressive jackpot, the casino may have technicians come and check the machine to certify that it was functioning properly when the jackpot hit. If you hit one of the wide-area progressive machines such as MegaBucks, the slot company that operates the game comes out and verifies that machine before giving you a check.

When you hit a jackpot, you have the option of taking your winnings in cash or check. Usually, large amounts are paid by check. In the case of the MegaBucks or similar multi-million dollar jackpots, you receive a check for the partial amount, and then you have 90 days to decide if you want to be paid a lump sum or an annual annuity on the balance. If you select the lump sum option, you receive only a percentage of your actual winnings. For example, the full winnings of one multi-million slot jackpot is paid in 25 annual installments, or you can take a lump sum of 60 percent of the winnings.

IRS Withholding

All casino winnings are subject to federal taxes. However, the IRS only requires the casinos to report wins over $1,200 on slots and video poker machines or other games such as keno, lottery or horse racing. When you have a win equal to or greater than $1200, you are issued a W-2G form. This form lists your name, address and Social Security number. The casinos are not required to take out withholding tax on jackpots under $5,000 as long you supply your Social Security number. If you don’t provide your Social Security number, the casinos withhold 28 percent on small jackpots.

You can request a specific amount of withholding tax to be taken out of any jackpot you win. Some players like to do this to avoid a big tax payment in April when they file their income tax returns. The additional withholding may not be necessary if you keep a log book. The law allows you to deduct gambling losses up to the amount of your winnings. You can only do this if you have documentation of your losses. Keeping a diary or log book is the way to do this.

Pa Tax Rate On Gambling Winnings Money

Proper Identification

Casinos can refuse to pay you until you produce proper identification—a photo ID such as a driver’s license, military ID or passport.

If you don’t produce an ID, you are photographed and the casino holds your winnings until you come back with proper ID. For this reason, you should always carry a valid form of identification with you when you visit the casino.

When the casino checks your identification, it also checks your age to make sure you are legally old enough to play. The minimum age for gambling varies from state to state, but under-age gamblers are not be paid if they hit a jackpot. This is the law in all jurisdictions, and it has been upheld in court.

Plan Ahead

Before you start playing your favorite slot machine you should have a plan for the day you hit a jackpot. Players become excited when they hit the big one, and this may affect the decisions you make about your winnings. It is helpful if you know ahead of time how much withholding you want taken out or whether you want a check for all or some of the amount.